Pension Calculator Germany

Calculate your pension gap quickly and easily

How big is my pension gap? How much do I need to save each month to be able to live well in old age and how much pension entitlement have I actually earned so far?

You can calculate your pension quickly and easily with just a few clicks using the pension calculator. You can immediately see how high your current pension entitlements are and what you still need to do to lead a carefree life in old age.

Please note: Only the colored fields can be written and changed. You will find a detailed completion guide below the calculator.

Sie sehen gerade einen Platzhalterinhalt von Standard. Um auf den eigentlichen Inhalt zuzugreifen, klicken Sie auf den Button unten. Bitte beachten Sie, dass dabei Daten an Drittanbieter weitergegeben werden.

Weitere Informationen

Below you will find all the instructions on how to complete the calculator and where to find the required data.

The aim of the calculator is to show you how high your current pension entitlements are and what else you may need to do to achieve your desired pension in old age.

In order not to make the whole thing too complicated, we work with predefined lump sums in some places. This makes the calculator much easier to use and still produces results that are very close to reality.

If you need advice on pension planning, you can find it here: Financial advice for expats.

Video pension calculator (calculate pension gap)

Sie sehen gerade einen Platzhalterinhalt von YouTube. Um auf den eigentlichen Inhalt zuzugreifen, klicken Sie auf die Schaltfläche unten. Bitte beachten Sie, dass dabei Daten an Drittanbieter weitergegeben werden.

Mehr InformationenDetermine your desired pension

The personal desired pension is one of the most important variables to consider in the calculator. This value is very individual and can vary greatly from consumer to consumer.

The value is calculated here without inflation and without tax. In other words, you enter the value that you would like to have available each month in old age in order to be able to spend it.

Many people find it difficult to give a realistic value here. This is mainly due to the fact that it is difficult to say today how much money you will really need to live on later. A good and easy way to approximate this is to use today's net income.

In other words, you simply assume that you would at least like to maintain your current standard of living in old age. In this case, you enter your current monthly net income.

Age today / retirement / pension payment until

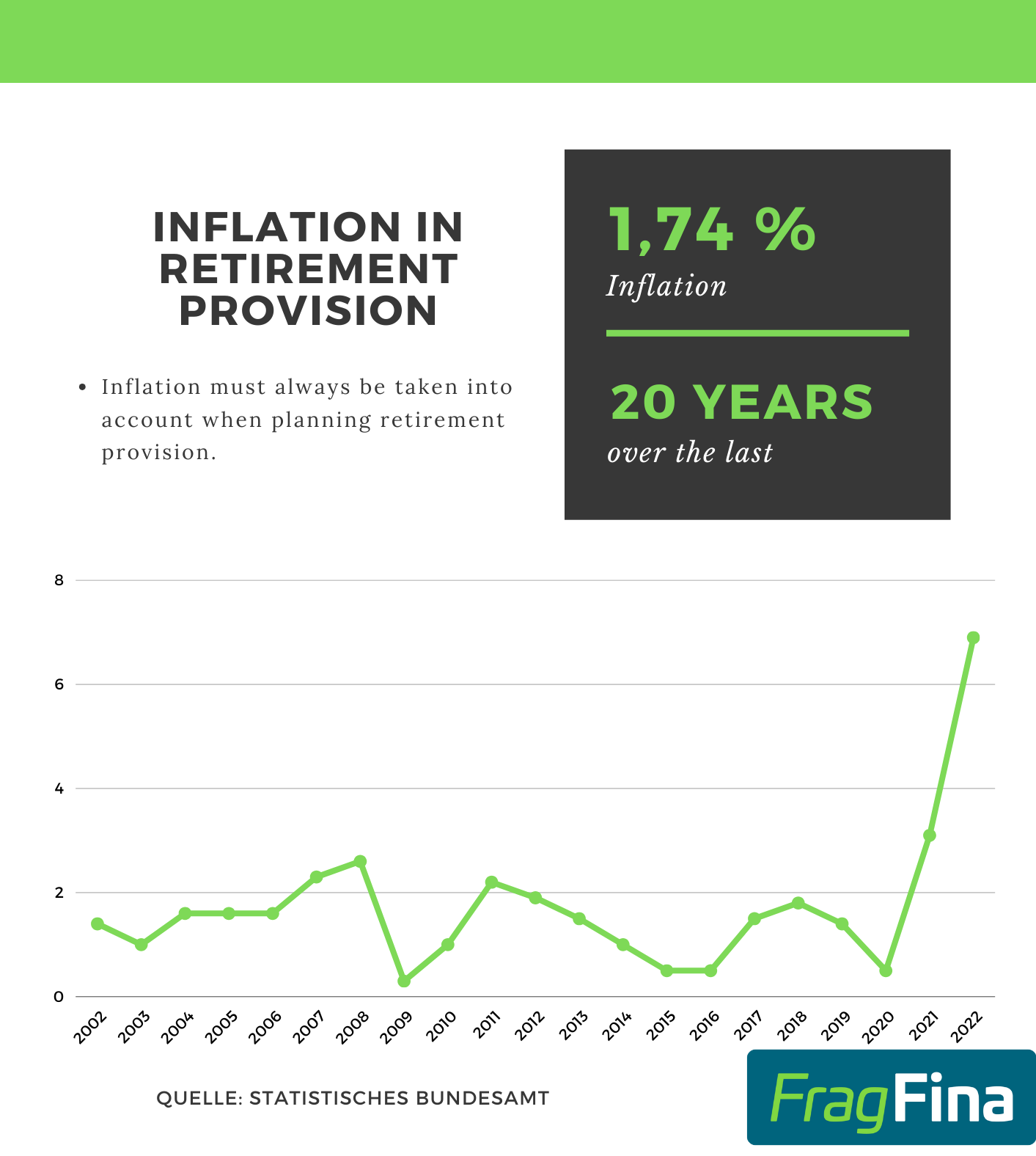

Inflation in pension provision

Inflation has a major impact on the calculation of the pension gap. With inflation of 2%, for example, purchasing power halves every 35 years.

For this reason, it is important to include inflation in the calculation. However, it makes sense not to speculate wildly here, but to refer to historical data.

Over the last 20 years, for example, we have had an average inflation rate of 1,74% (see chart).

Performance in the savings phase

The level of performance is a decisive factor in determining how high the required monthly savings installment will be. The higher the performance (i.e. the interest rate), the lower the required savings installment or the required capital.

But what is the best interest rate to use here? The level of interest depends on which asset classes you choose and, above all, on how much risk you want to take.

As a guide, we provide three performance corridors that reflect reality well. The three areas differ mainly in terms of the risk you want to take:

Defensive

Balanced

Offensive

The more risk you are prepared to take, the greater the likelihood of achieving a higher return. However, more risk is no guarantee of a higher return. It is important to invest strategically and sensibly.

It should also be noted that the stated returns are after-cost returns. This means that what is actually generated should be stated. This means that the costs of the respective investment are automatically taken into account.

As you can see, a general return is recorded and not a separate performance for each individual investment. In practice, it will be the case that one investment performs better and another investment performs worse. Ultimately, the average return across all investments is decisive. We map this with the general performance field.

Performance in the withdrawal phase

The performance in the withdrawal phase indicates the return that the accumulated retirement assets will generate from the age of 67. In principle, this works according to the same logic as the return in the savings phase. The more risk you take, the higher the potential return.

However, as you can see, the returns on the options are lower. This is because you should generally be a little more conservative in the payout phase.

The background to this is that we have now reached the point where we actually need the capital. Not all at once, which is also the reason why you should remain invested. However, a small amount of capital is needed every month. This must be liquid and should not fluctuate too much during the withdrawal phase.

Defensive

Balanced

Offensive

Taxes and social security contributions

Tax and social security contributions must still be paid in retirement. However, the taxes are not the same across the board for every type of pension income, but vary greatly depending on the type of income.

Income from a custody account, for example, is taxed differently to payments from a Riester pension.

To avoid making this part too complicated, we have decided to work with flat-rate values here. Practical experience has shown that the flat-rate values can be used to represent reality almost exactly.

Public pension schemes

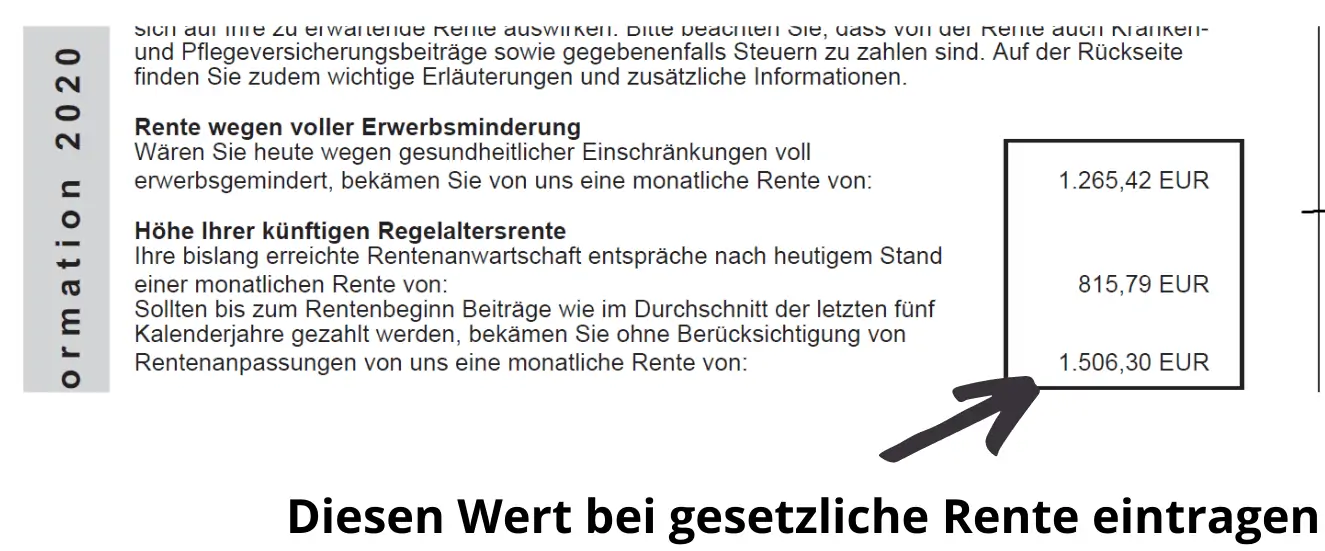

Entitlements from the statutory pension insurance scheme

If you have already received pension information from Deutsche Rentenversicherung, you can find your entitlements from the statutory pension insurance scheme in this document. For the calculation, you should not take the currently acquired entitlements, but the projected ones.

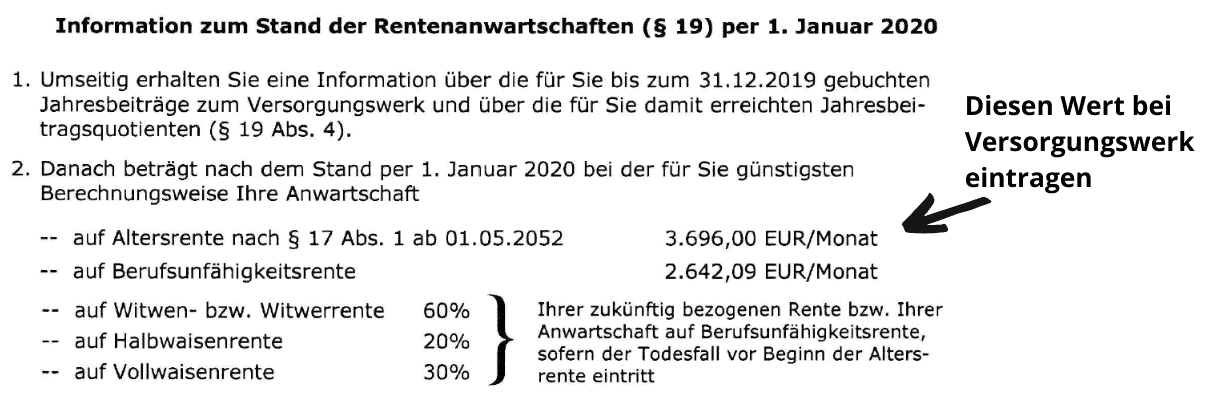

Claims from the pension fund

If you are a member of a professional pension fund, you do not pay into the statutory pension, but into the corresponding pension fund. As a result, you will receive your pension from the pension fund. Here, too, you will receive annual information about the entitlements you have accrued to date, which you can transfer to the calculator.

Insurance policies

If there are already any pension plans via insurance solutions (3-tier model), these should also be included. These include basic pensions, Riester pensions, occupational pension schemes and pension insurance.

Two pieces of information are required for recording. Firstly, the current monthly payment amount. The easiest way to find this is to look at your bank statement. Simply check what is transferred to the insurance company each month.

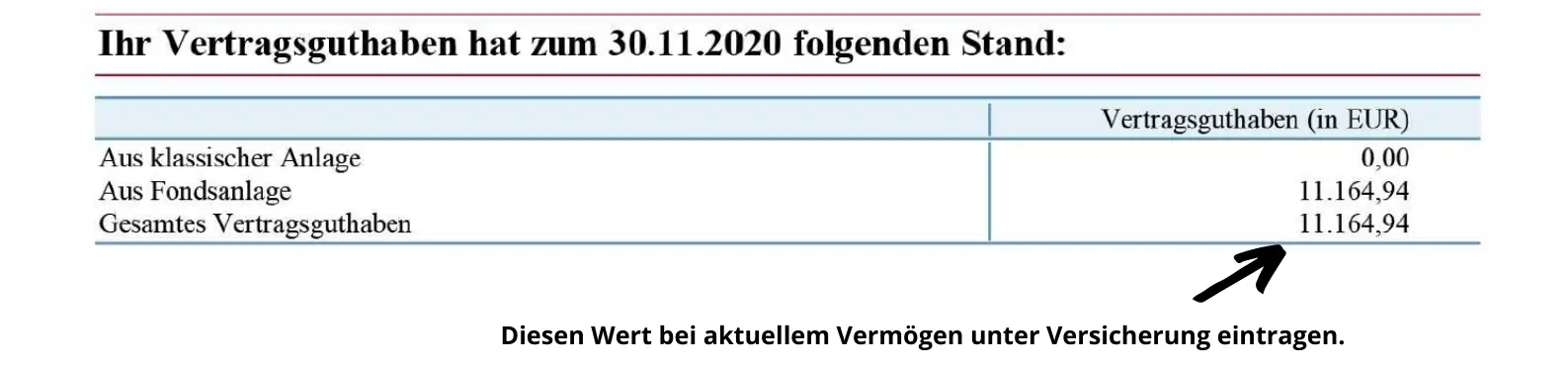

Secondly, the current assets already saved in the contract. You can find this in the annual statement you receive. These statements look different depending on the provider, but the designations within the documents are usually very similar.

Here is an example of what it might look like:

Investments

There are two things that can be recorded in the area of investments. The first is the current savings rate and the second is the assets you have already built up.

For the savings rate, you simply record the value that you currently invest in funds, ETFs, shares or other capital market investments each month. If you are not sure exactly how much this is, simply check your current account statements.

Under existing assets, you record the amount that is currently in your custody account. In other words, what you have already paid in in the past, including the performance. To do this, simply log in to your custody account(s) and check the current custody account balance.

Real estate

When it comes to real estate, there are two things that can be taken into account. On the one hand, there is the so-called investment property, i.e. a property that is rented out, and on the other hand the owner-occupied property. In other words, the property you live in yourself.

In the case of the owner-occupied property, the monthly net cold rent must be recorded for the calculator. In other words, the monthly rent paid by the tenant minus service charges.

You can find more information on the topic of rented property as an investment here.

In the case of an owner-occupied property, it is only recorded whether there is one or not. The calculator assumes that the property is paid off at retirement age and that you continue to live there.

As a result, a flat rate of 20% is deducted from the assets required for retirement provision in the case of an existing property.

Result of the pension calculator

After entering all the relevant data, the calculator provides you with various pieces of information. You will find out how much wealth has been built up so far for old-age provision and how much additional wealth needs to be built up in order to achieve the desired pension.

In addition to these two values, the calculator also shows the required monthly savings rate. In other words, you can see at a glance how much you would have to save each month from now on (based on the information provided) in order to achieve the desired pension in old age.

Source reference:

Deutsche-Rentenversicherung.de: Muster und Erklärung der Renteninformation ; https://www.deutsche-rentenversicherung.de/SharedDocs/Bilder/DE/Pressebilder/sonstige_pressebilder/renteninfo_inhalt_artikel.html (Abruf 11.2023)

de.Statista.com: Inflationsrate in Deutschland von 1950 bis 2020; https://de.statista.com/statistik/daten/studie/4917/umfrage/inflationsrate-in-deutschland-seit-1948/ (Abruf 11.2023)

Deutsche-Rentenversicherung.de: Besteuerung der Rente ; https://www.deutsche-rentenversicherung.de/DRV/DE/Rente/Allgemeine-Informationen/Besteuerung-der-Rente/besteuerung-der-rente_node.html (Abruf 11.2023)

Test.de: Steuern und Sozialabgaben / Diese Abgaben zahlen Sie auf Ihre Rente; https://www.test.de/Steuern-und-Sozialabgaben-Diese-Abgaben-zahlen-Sie-auf-Ihre-Rente-5542858-0/ (Abruf 11.2023)